Over the past week, investors have been entangled in weighing the risk of rising infections against the reward of a smooth reopening (economic recovery). In the midst of a turbulent market, Fed intervention has swayed the invisible hand.

The recent expansion of the Federal Reserve’s supervision and regulation duties has been historic in scope. One of the first examples of this occurred towards the end of last year, when the central bank started actively intervening in the overnight repo markets as interest rates soared to 10%, way past the 2% target rate set by the Fed.

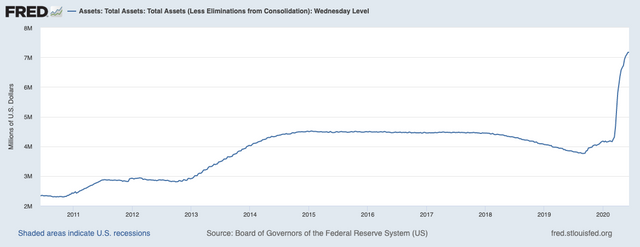

As a consequence of a liquidity crunch, soaring rates in the repo market led the Fed to buy short-dated treasury bills, and then roll over their positions after consecutive weeks and months. The total procurement amounted to upwards of $500 billion. Officially, the Federal Reserve labeled the program as “repo operations” rather than classifying it as a Quantitative Easing (QE), which involves the purchase of longer-dated Treasury securities

Then came a pandemic that jolted the US economy into its worst contraction since the Great Depression. In contrast to the recessions of the past (2008), this time around Fed response was swift and expansive. Intervention in the aftermath of 2008 was delayed and carefully weighed, in order to prevent inciting fear in the financial markets.

This time around, things are different. The depth of market intervention by the central bank has penetrated deeper than the mere purchase of short-dated T-bills. Not only did the central bank announced that it would be buying $750 billion worth of investment-grade corporate bond ETFs, but also added on Monday that its new lending facility will dip its toes in the sale and purchase of individual corporate bonds.

Additionally, the Main Street Lending Program announced in April would allow the central bank to purchase 95% of the loans that banks have made to small businesses. By limiting the private lender risk of small banks to 5%, the Fed intends to discourage irresponsible lending. In essence, the Fed would take over the private risk borne by commercial banks as lenders to small businesses.

This asymmetric transference of risk has come with its fair share of surprises. As findings reveal, the central bank owns the debt on two companies – Hertz Global Inc. and JC Penney – through its ETF exposure. The result: both firms have seen their stock soar over 100% after they each filed for Chapter 11 bankruptcy protection.

Last month, chairman Jerome Powell defended Fed intervention in an online event hosted by Princeton University. “We crossed a lot of red lines that had not been crossed before,” Powell said, “I’m very confident that this is the situation where you do that and then you figure it out.”

As investors weigh recession against recovery, we are yet to witness what happens when the dust settles.